Best ETF Brokers

Exchange-traded funds (ETFs) are instruments that enable you to articulate your market or sectoral perspectives, whether at the domestic or global level. Yet while these investment vehicles are traded on exchanges just like regular stocks, you still need a trustworthy broker with a wide range of ETFs, low costs, and high-quality platforms.

List of Best Brokers For ETFs 2024

Our team have analyzed and compared numerous platforms to find the top 5 ETF brokers:

- eToro: Best For Beginners

- IG: Best For ETF Markets

- Pepperstone: Best Trading Platforms

- XTB: Best For Commission-Free ETFs

- Webull: Best For US Traders

Comparison of Top 5 ETF Brokers

| eToro | IG | Pepperstone | XTB | Webull | |

|---|---|---|---|---|---|

| Number of ETFs | 300+ | 5,400+ | 100+ | 350+ | 3,300+ |

| Minimum Deposit | $50 | $250 | $0 | $0 | $0 |

| Platform | Own | Own, MT4, ProRealTime | MT4, MT5, cTrader, TradingView | Own | Own |

| Regulated | Yes | Yes | Yes | Yes | Yes |

eToro: Best For Beginners

eToro is a top-rated multi-asset platform. Launched in 2007, the brand has millions of active traders globally and is authorized by tier-one regulators, including the FCA and CySEC.

Why We Chose It

We recommend eToro for ETFs because of several factors:

- You can trade 325 ETFs spanning index ETFs, dividend ETFs, bond ETFs, and commodity ETFs.

- ETF fees are low and leverage is in line with regulatory requirements, helping to provide a secure investing environment.

- It offers one of the best web platforms we have used and comes with social investing that lets you copy the trades of experienced ETF investors.

- There are comprehensive free learning tools via the eToro Academy, ideal for beginners.

- Leverage ETF trading is available in Europe, Australia and other markets around the world, but not in the US because it is prohibited by the country’s regulators.

- An excellent broker for beginners, but its relatively limited ETF selection might limit the platform’s appeal to intermediate and advanced investors.

IG: Best For ETF Markets

IG is an established broker authorized by reputable regulators, including the FCA, NFA, CFTC and ASIC. The award-winning firm has over 300,000 clients and offers a huge range of ETFs.

Why We Chose It

We recommend IG for ETFs because of multiple reasons:

- Access to the broadest selection of ETFs, with over 5,400 funds covering indices, commodities, and currencies. This allows you to diversify your portfolio across various asset classes, sectors, and regions.

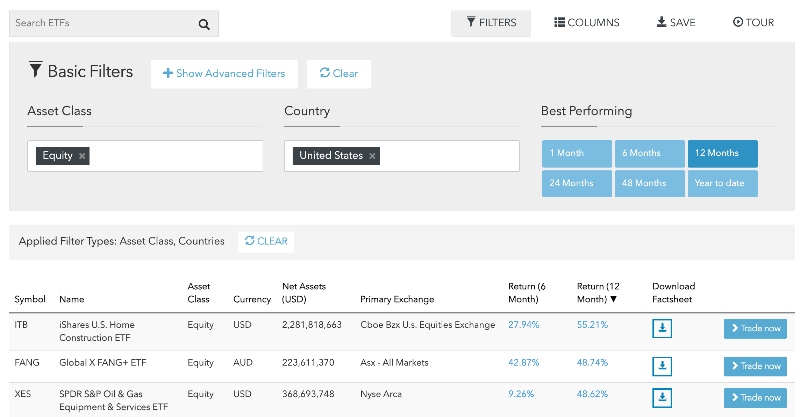

- The ETF screener enables you to filter by asset class, country and best-performing funds over timeframes from 1 month to year to date.

- An intuitive and user-friendly platform with a range of research tools, charts, and technical analysis resources to assist you in making informed decisions.

- Competitive pricing, including relatively low commission fees or commission-free ETFs on certain accounts, helping you to reduce costs.

- Educational materials, webinars, and market analysis to help those new to ETF investing.

- Fees for CFDs are higher than competitors we reviewed.

Pepperstone: Best Trading Platforms

Pepperstone is a leading online broker with hundreds of thousands of clients, multiple awards and strong regulatory oversight. It will meet the needs of a range of ETF traders with a $0 minimum deposit, reliable tools and competitive fees.

Why We Chose It

We recommend Pepperstone for ETFs for several reasons:

- You can trade 100+ ETF CFDs covering technology, retail, mining, energy and bond markets. You also get exposure to equity markets in 35 countries spanning 6 continents.

- ETFs are traded on direct underlying exchange prices with no additional mark-ups added to the bid/offer spread. Instead, there is a small commission of $0.02 per trade.

- MT5, MT4, cTrader and TradingView platforms are all available on your computer, mobile and tablet. These are some of the best platforms for retail investors. Automated systems are also supported on MT5 where you can speculate on ETFs.

- Deposits and withdrawals are free and can be made to Visa, Mastercard, bank transfer, and PayPal.

- Educational materials are better than the average, but are not as good as some of the best ETF brokers such as eToro and IG.

XTB: Best For Commission-Free ETFs

XTB is one of the largest stock exchange-listed forex and CFD brokers, boasting 700,000 active traders, 20 years of experience and authorization from reputable regulators, including the UK’s FCA and the Polish KNF.

XTB is a great option for ETF investors with a user-friendly platform, no minimum deposit and low fees.

Why We Chose It

We recommend XTB for ETFs due to multiple factors:

- You can trade more than 300 ETFs spanning various companies, commodities and industries with zero commissions.

- Consistently low spreads on ETFs are hard to ignore as they separate XTB from the competition.

- The minimum order size for ETFs is low at €10.

- Non-EU, UK and Australian accounts can trade with up to 1:500 leverage. This will serve experienced traders with a sensible approach to risk management.

- Phone and live chat support are reliable, fast and available in many languages 24/5.

- The proprietary web-based platform for ETF investing is excellent, but there is no support for MetaTrader, cTrader or TradingView.

- Monthly volumes over €100,000 will incur a commission of 0.2%.

Webull: Best For US Traders

Webull is an online broker with headquarters in New York and authorization from the SEC and FINRA. Its platforms are extremely user-friendly and offer many functions, making it one of the best ETF apps for US traders.

Why We Chose It

We recommend Webull for ETFs because of several factors:

- A diverse selection of ETFs allows you to build a well-rounded and diversified portfolio across various asset classes, sectors, and regions. More than 3,300 ETFs are available in the app.

- Commission-free ETFs can significantly reduce costs and make it more accessible to buy and sell funds.

- Although proprietary, the platform is user-friendly and equipped with advanced charting tools, technical analysis indicators, and real-time market data, making it suitable for both novice and experienced investors.

- The platform offers various research resources, including news, stock screeners, and market analysis, helping you make informed decisions and stay updated on ETF market trends.

- Extended hours, including pre-market and after-hours access, providing flexibility if you want to take advantage of price movements outside of regular market hours.

- Although opening an account is fast and easy, only bank transfers are supported for deposit/withdrawal.

- Disappointingly, there is no live chat support.

How To Find The Best Brokers For ETFs

Choosing the best broker to trade ETFs involves careful consideration of your individual needs and preferences. However, here are the key areas we took into account:

Available ETFs

First and foremost, you need to ensure the broker offers a wide range of ETFs that align with your strategy. This may include funds covering various asset classes, sectors, and regions.

In our experience, the top ETF brokers offer funds spanning stocks, commodities, and bonds with access to popular funds like the SPDR S&P 500 ETF Trust (SPY), Invesco QQQ Trust (QQQ) and iShares 20+ Year Treasury Bond ETF (TLT).

Tools and Resources

Look for an ETF broker that provides the platform you are used to. In our experience, MetaTrader 4, MetaTrader 5 and cTrader are the most popular third-party solutions available.

The platforms should include intuitive access to real-time market data, research reports, and charting capabilities. Mobile app availability may also be crucial if you want to trade ETFs on the go.

If you are new to ETFs, we recommend testing its various platform choices with demo accounts to make sure they are user-friendly.

In addition, we favor brokers that offer intuitive ETF screeners that can help you find suitable funds based on asset class, region and performance.

Costs and Fees

Fees are an important consideration for our team. Many brokers now offer commission-free ETFs, but it is important to review spreads any check for any additional charges.

For example, we found that commission-free ETFs are sometimes only available up to a certain monthly volume, after which a transaction fee applies. You may also need to pay an expense ratio, which is essentially a charge for managing the fund.

Ultimately, a transparent pricing structure is a good indication that the ETF broker is reliable and trustworthy.

Leverage

Leverage can amplify both gains and losses, so it is crucial to have a clear understanding of how it works and to use it cautiously. Brokers also charge for using leverage. Most long-term investors in ETFs tend to avoid leverage, while it may be more relevant for short-term traders.

Several regulators restrict leverage to 1:30 for retail traders, including in the UK, EU and Australia, however some brokers offer higher rates for professional investors or to clients who sign up through their offshore entities. Importantly, offshore brokers tend to offer less legal protection so we recommend caution.

Security and Regulation

Safety is of utmost importance, so our team prefer ETF brokers who hold licenses with trusted regulators. This is especially important with strategies using ETFs, where funds can be invested with a broker for weeks or months.

We verify that the broker is regulated by a reputable authority, such as the Securities and Exchange Commission (SEC) in the United States, the Financial Conduct Authority (FCA) in the UK, or the Cyprus Securities & Exchange (CySEC) in Europe. This should ensure they provide strong security measures to protect your account and personal information.

Methodology

To find the top brokers for ETFs, we analyzed firms across several key categories; the range of ETFs, the fees and costs, the quality of the investing platforms and tools, and the firm’s reputation and regulatory status.

As well as considering quantitive metrics, our ratings were informed by qualitative insights gathered during the evaluation stage.

This approach enabled us to compile a list of the 5 best brokers for ETFs.

FAQ

What Is An ETF Broker?

An ETF broker is a financial intermediary or brokerage firm that facilitates the buying and selling of ETFs. These brokers provide a platform or app that allows you to access a range of ETFs, execute trades, and manage your portfolios.

The best ETF brokers offer various tools, research, and educational resources to help you make informed decisions when investing in ETFs.

Which Is The Best ETF Broker?

The best ETF brokers are eToro, IG, Pepperstone, XTB, and Webull. They are all regulated, offer a good breadth of ETFs, competitive fees and high-quality platforms and tools, including screeners to help you find funds that align with your financial goals.

Is A Margin Account Needed To ETFs?

No, a margin account is not typically needed to trade ETFs. Most brokerage accounts allow you to buy and sell ETFs using a cash account, where transactions are funded only with the cash available in the account.

However, some traders may choose to use a margin account to potentially amplify their ETF positions by borrowing funds from the broker, but this involves additional risks and margin requirements. It is essential to understand the implications of margin before using such accounts.

Article Sources

- eToro - ETF Conditions

- IG - ETF Conditions

- Pepperstone - ETF Conditions

- XTB - ETF Conditions

- Webull - ETF Conditions

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com