Dividend Capture Strategy Using Options

Traders who use a dividend capture strategy usually trade in and out of a stock to obtain the stock’s dividend without having to hold it long-term.

Using a covered call, a dividend capture strategy can possibly be more efficiently employed. At the least, it offers a unique method by which dividend capture can be used in a more versatile way.

First, some terminology:

Declaration date

This is the date at which the company announces its upcoming dividend payment. Most companies pay dividends quarterly. Some pay monthly.

For example, a company could communicate that it will issue a dividend of $1.00 per share on said date.

Ex-dividend date

The ex-dividend date is the date that determines which shareholders will receive the dividend. To receive the dividend, you should be in the stock at least by the evening of the day before the ex-dividend date.

The ex-dividend date is often called the ex-date.

Record date

The record date is the date at which a company will look at its list of shareholders and determine who will get the dividend. Only shareholders who are registered on the company’s books as of the record date will receive it.

The record date is often set two days after the ex-dividend date.

Payment date

The payment date, also called the pay date or payable date, is when shareholders actually receive the dividend. It is usually within 30 days of the ex-dividend date, and normally no less than 5 days.

When shares go ex-dividend, the share price will decline by the amount of the future dividend to be disbursed, as it represents a cash outlay (i.e., a decrease in the company’s assets, thus lowering its equity value).

Most brokers, to avoid swings in portfolio value caused by the ex-dividend related drop, will credit accounts with a “dividend payable” between the ex-dividend date and the payment date.

Example dividend distribution timeline

An example timeline of this process could go as follows:

- Declaration date: March 6

- Ex-dividend date: March 13

- Record date: March 15

- Payment date: March 31

Traders using a dividend capture strategy will want to buy in before the ex-dividend date.

However, because of the equivalent decline in the share price on the ex-dividend date, you may not necessarily “miss out”. Because shares decline by the dividend amount, holding all else equal, if you buy on or very shortly after the ex-dividend date, you may actually obtain a discount when the share price drops. Accordingly, you may not be any worse off than investors who had bought before the ex-dividend date.

Dividend Capture Strategy Using Options

Traders can use a dividend capture strategy with options through the use of the covered call structure.

A covered call is a strategy by which you buy the underlying security while selling an equivalent amount of call options to “cover” the position. When you sell a call option, you receive the premium. This has the function of capping your upside on the stock.

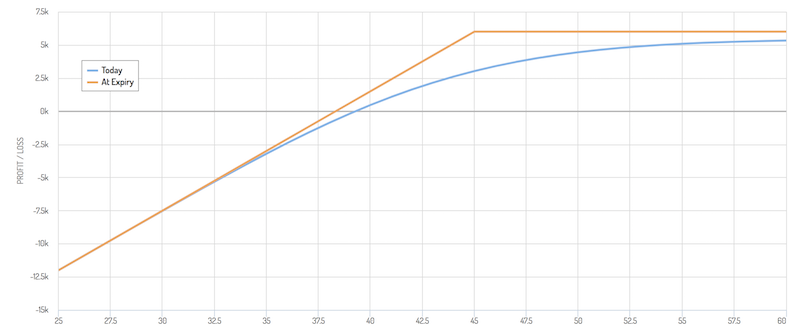

Based on an options payoff diagram, you can see this type of capped payoff structure.

There are 100 shares of a stock per each options contract. This means that if you owned 1,000 shares of a certain stock and wanted to form a covered call, you’d need to short (or sell) 10 options contracts on that security.

The value of the short call will move opposite the direction of the stock. Accordingly, this is inherently a type of hedged structure.

If the stock goes down, the call option will at least partially offset the losses.

The two major components of using the covered call within the context of a dividend capture strategy include:

(i) The strike price of the option

(ii) The days to expiration (DTE) of the option

To a lesser extent, there’s the consideration of when to put the position on relative to the ex-dividend date.

Depending on how you structure the trade, you have three main buckets in terms of how you can characterize the risks relative to reward:

(i) Low risk: Options are too deep in the money (ITM), which comes with the drawback of early assignment, covered in more detail in a portion of this article.

(ii) High risk: Options are too far out of the money (OTM), and don’t provide enough hedge value.

(iii) Moderate risk: At the money (ATM) options (or thereabouts), which gives you a quality hedge, but lowers early assignment risk.

We’ll go through each individually.

Covered call dividend capture strategy risk profiles

(i) Low risk

Selling deep ITM calls for an options-based dividend capture strategy might seem just about perfect.

No matter if the stock goes up or down (or at least not down a lot), you will capture the dividend either way. The hedge value is the highest and your risk is low.

However, the more ITM your call is, the greater the early assignment risk.

That means on the day before the ex-dividend date, an option with a dividend value that’s higher than the extrinsic value of the option (i.e., the value of the time premium plus implied volatility) is likely to be assigned.

That’ll call away your stock and you won’t get the dividend. The owners of the option – i.e., the party on the other side of the trade – is probably not going to passively allow you to collect the dividend that easily. That’ll close out the position.

When early assignment occurs, your return on the trade is effectively reduced to the premium of the option when you opened the position minus the price you paid for the stock.

For example, if you bought a stock for $100 and simultaneously sold call options on the stock at a 100 strike price, if you’re assigned early, your return would be equal to the option’s premium.

If you had bought the stock for $101 and sold calls at a 100 strike for a $3 premium, your net return is the options premium minus $1 per share – i.e., $3 premium from the option minus the $1 the shares were in the money, for a $2 per share profit.

If you had purchased the stock for $99 and sold calls at a 100 strike for a $3 premium, your net return would be the options premium plus your realized gain on the shares, which would be $4 per share – i.e., $3 premium from the option plus the $1 realized gain per share.

Some inexperienced traders try to use this low risk, deep ITM dividend capture strategy only to find out about the early assignment issue that derails their plans.

Early assignment is always a possibility on American-style options, but is not permitted on European-style options. If you are trading US stocks and options on them, you can be pretty sure you are dealing with American-style options, which bear early assignment risk.

Not all deep ITM options will be exercised. But as a general rule of thumb, if the extrinsic value of an option is lower than the dividend, the party on the other side of the trade will be motivated to exercise their option early to capture it.

Example

Let’s say you own a stock trading for $105 that’s covered with 100 calls. The intrinsic value of the option will be $5 per share – the $105 minus the 100 strike price.

Let’s say the annual dividend is $4 per share, or $1 per quarter. The option expires sometime after the ex-dividend date, so this is the only dividend compensation that will come up over this option’s remaining maturity.

If the option is priced at $5.50 per share, is the option owner likely to exercise early assignment?

Most likely they will.

We know the intrinsic value of the option is $5. That means the extrinsic value of the option is the difference between its price ($5.50) and the $5 intrinsic value, or $0.50.

The quarterly dividend distribution is $1, which is higher than the $0.50 extrinsic value. So, yes, the owner is most likely going to be choosing early assignment. It is not a guarantee, but it is likely.

(ii) High risk

If you place your call options too far OTM, you will lower the risk of early assignment. But they will lack much in the way of hedge value and you won’t materially lower your downside protection.

Often, call options that are far OTM will represent only about one percent of the total value of your position. In other words, if it falls 20 percent, which is natural for a stock, it doesn’t provide much in the way of reducing your downside.

For example, let’s say Apple (AAPL) is $300 per share. 400 strike calls out one year are about $4 per share. That means the value of your hedge when going 33 percent OTM (400 strike price divided $300 share price) is only just over one percent ($4 per-share premium of the option divided by the $300 stock price).

If Apple’s dividend is 3 percent per share and the hedge value from the call option is 1-2 percent, that means just a 4-5 percent drop in the stock would wipe out an entire year’s worth of dividend capture.

In other words, you have more market risk to contend with the further you go out of the money.

If you are trading more short-term (e.g., less than 30 days until expiration) and want to go just a few percent OTM, your hedge value will often be less than one percent of the size of your position (and sometimes lower).

(iii) Moderate risk

Choosing call options that are slightly OTM or right around ATM will provide a quality combination of hedge value while mitigating options assignment risk.

You can apply this to a long-term or short-term strategy.

If you go longer-term, you can select call options out 6+ months. Because the extrinsic value of an option (time premium and implied volatility premium) will remain high on a long-term option until the end, early assignment is less likely until the final ex-dividend date within the option’s maturity.

But you must always remember that early assignment is a possibility any time that you are short an option that’s ITM.

If you’re working on a shorter time horizon, you can select call options out 30 days or less. The shorter-term you are, the more you can feel comfortable with selling an ITM call – but not an amount ITM that’s larger than the upcoming dividend payment.

If the stock goes up, then you risk early assignment. However, when the premium of the option you selected is at least comparable to the upcoming dividend payment, then you will collect that option premium if you are closed out early. Accordingly, it could be a bit of a wash in terms of the profit of the trade structure.

If the stock goes against you, then you have an adequate hedge against this via the option’s premium. It also increases your change of capturing the dividend. It will not, of course, protect against a major market move against you.

Conclusion

Covered calls can be used as a tool within the context of a dividend capture strategy.

Overall, covered calls are best in a flat or a weakly rising or weakly falling market. If markets rise a lot, then your upside is capped by the trade structure, so you miss out on those gains. If markets fall a lot, then you’ll still bear some downside – though not as much if you didn’t have options sold against your long position on the stock.

So, you must be prepared to accept the different drawbacks associated with more “extreme” market movements.

Also, be aware that the spreads on options can often be wide. Options are a useful and versatile tool, but wide spreads can often make their use prohibitive. If you are trading options with wide spreads, it is difficult to get fair value and makes it harder to profitably trade options over the long-run regardless of the strategy or way in which they’re employed.